A partnership regardless of the number of partners must also file. The part of any gain or loss from unrealized receivables or inventory items will be treated as ordinary income.

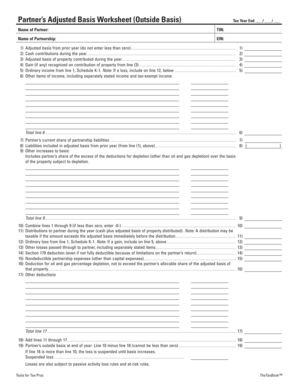

Partnership Basis Worksheet Excel Fill Online Printable Fillable Blank Pdffiller

Your goal is to move from a transactional relationship to a strategic partnership.

. Technical Termination of a Partnership For taxable years beginning on or after January 1 2019 California conforms to the TCJA repeal of the termination of a partnership by the sale or exchange of 50 percent or more of the total interest in a partnership within a 12 month period. Board resolution acquiror asset transfer Museums. 01 During the entitys tax year did the entity own any interest in another partnership or in any foreign entity that was disregarded as an entity separate from its owner under federal regulations Sections 3017701-2 and 3017701-3.

The term unrealized receivables includes income arising from compensation for services and depreciation recapture income discussed earlier. Worksheet 2 caters for those items that reconcile T Total profit or loss item 6 with T Taxable income or loss item 7 other than those items specifically included in item 7It does not contain an exhaustive list of reconciliation items. The sale of a partnership interest is treated as the sale of a single capital asset.

Bill of sale and assumption agreement. One-way information sharing non-disclosure agreement. Disposition of partnership interest.

Determines the gain or loss on the sale or exchange of a partnership interest Sec. High value to your sales team but remember. A sale means any conveyance grant assignment quitclaim or transfer of the ownership of or title to real property including standing timber or any estate or interest therein for a valuable consideration and any contract for such a conveyance grant assignment quitclaim or transfer and any lease with an option to purchase real.

Only when you understand your customers challenges can you help them differentiate their products and services. A partnership that has 10 or more partners must file Form NJ-1065 and make payments electronically. The role liabilities play in determining basis There is one temporary exception to the rule that a partners basis is equal to his or her cost basis in the partnership and that is the allocation for basis purposes of.

Every partnership having a New Jersey resident partner or deriving income loss from New Jersey sources must file a New Jersey partnership return Form NJ-1065. All references to accounts below are taken to mean the companys profit and loss account. Finally this publication contains worksheets to help you figure the amount of your deduction if you use your home in your farming business and you are filing Schedule F Form 1040 or you are a partner and the use of your home resulted in unreimbursed ordinary and necessary expenses that are trade or business expenses under section 162 and that you are required to pay under.

One way or another its always in your best interest to reach. Employee confidential information and invention assignment agreement. Free Account Planning Worksheet.

Mo 5090 Missouri Department Of Revenue

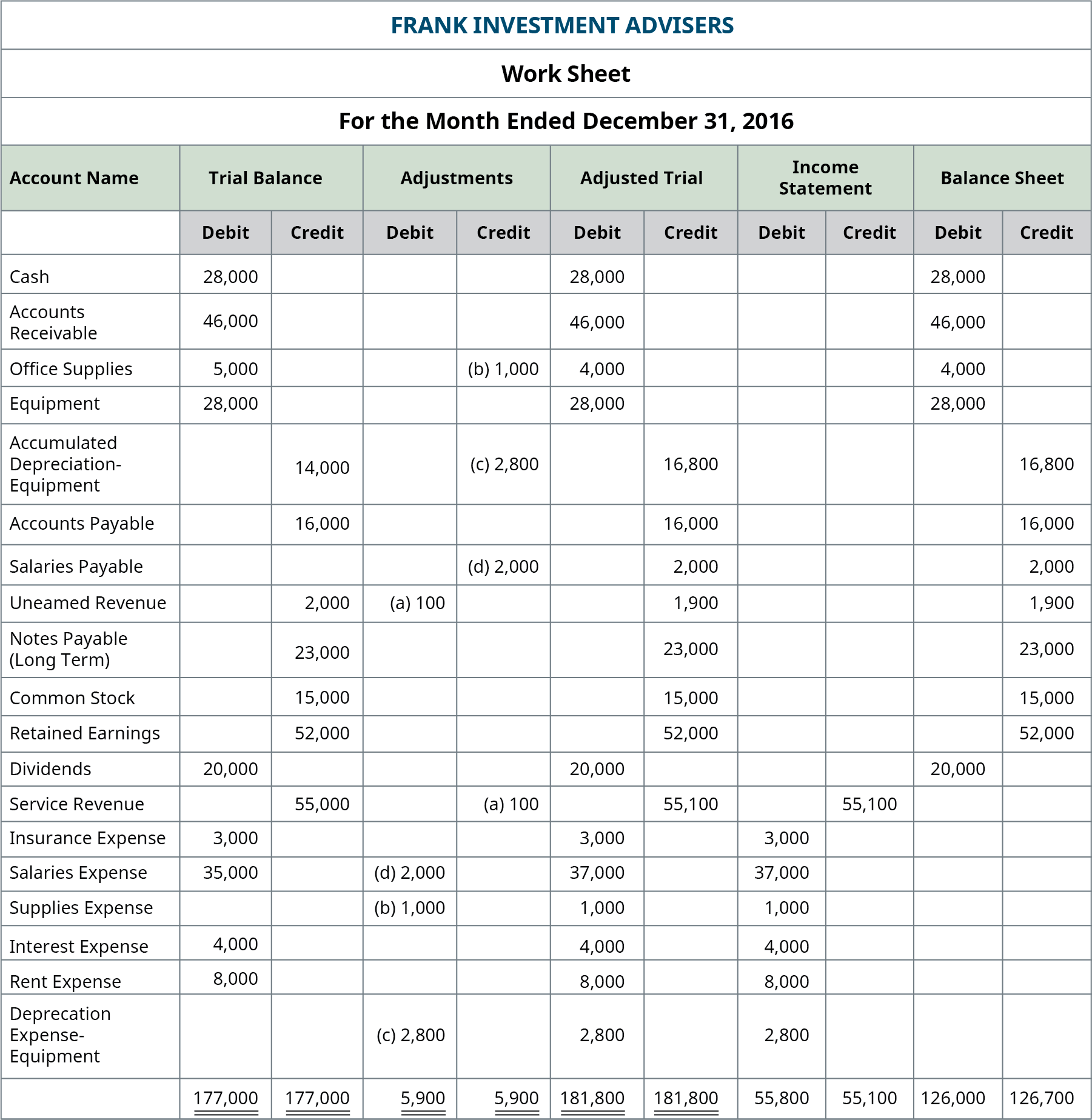

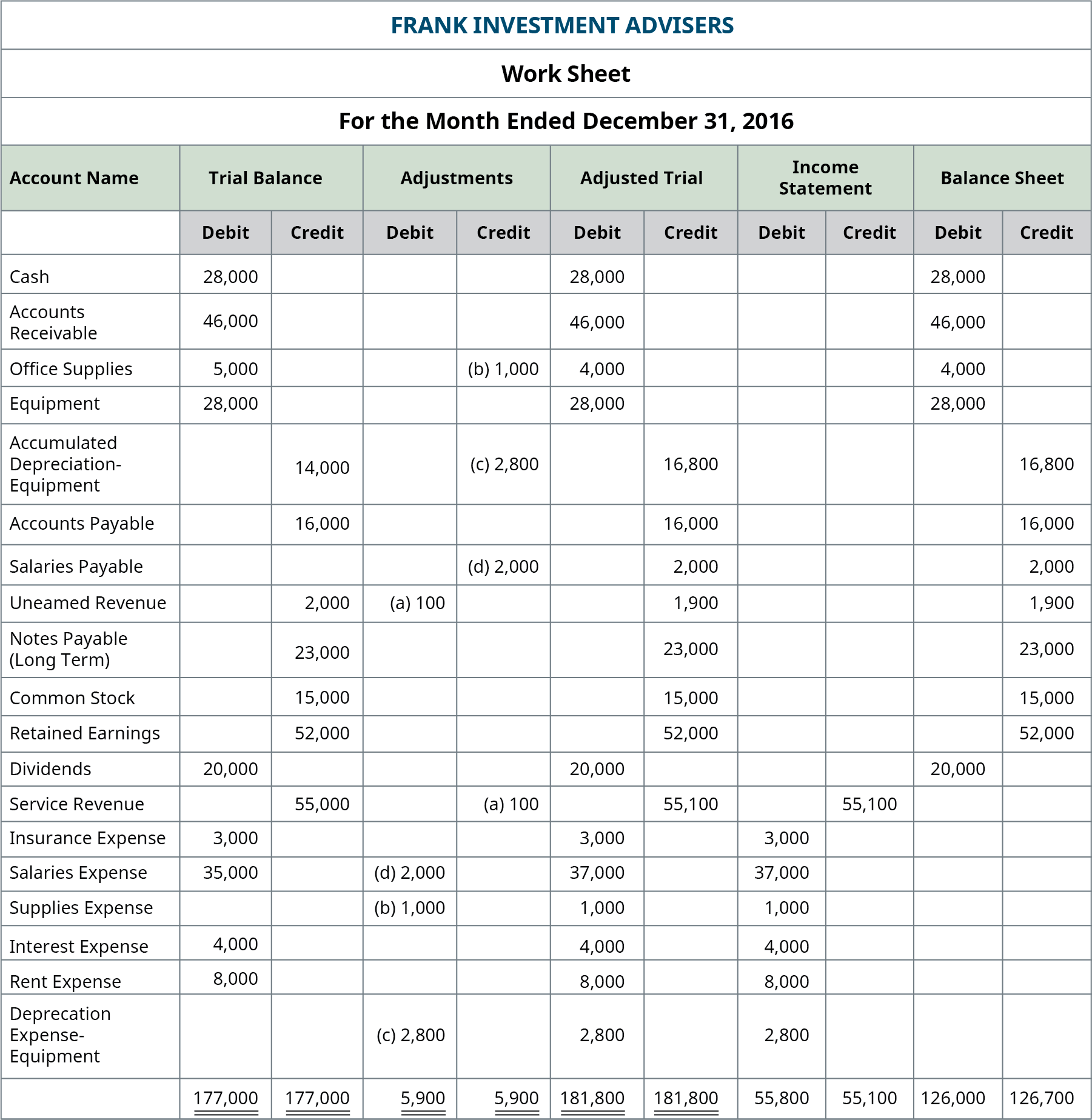

Prepare Financial Statements Using The Adjusted Trial Balance Principles Of Accounting Volume 1 Financial Accounting

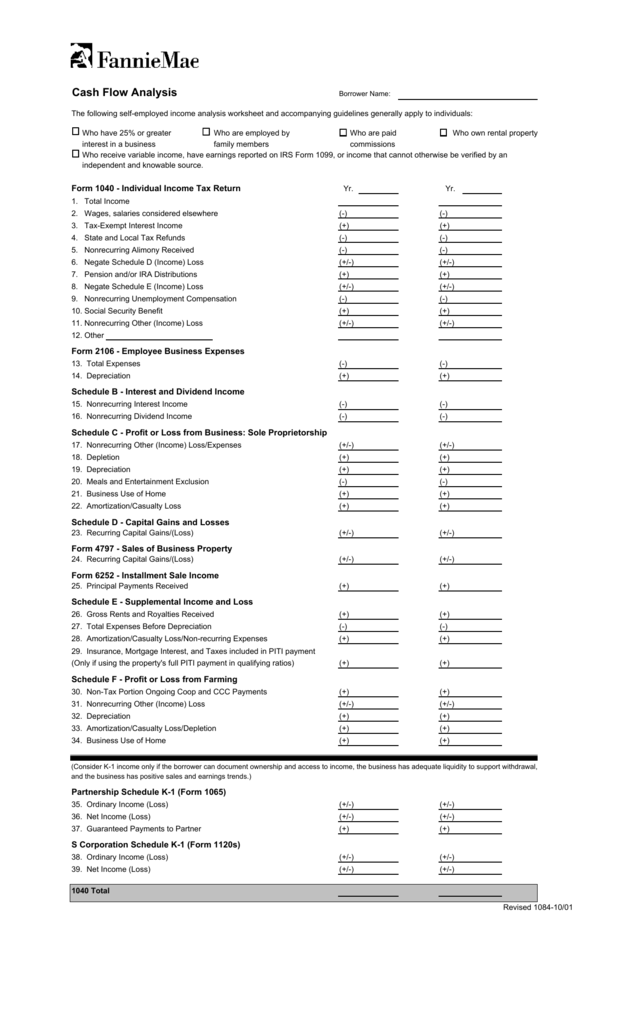

Cash Flow Analysis Form 1084 Pdf

Free Partnership Worksheet Free To Print Save Download

Partnership Basis Worksheet Excel Fill Online Printable Fillable Blank Pdffiller

Prepare Financial Statements Using The Adjusted Trial Balance Principles Of Accounting Volume 1 Financial Accounting

Reporting Publicly Traded Partnership Sec 751 Ordinary Income And Other Challenges

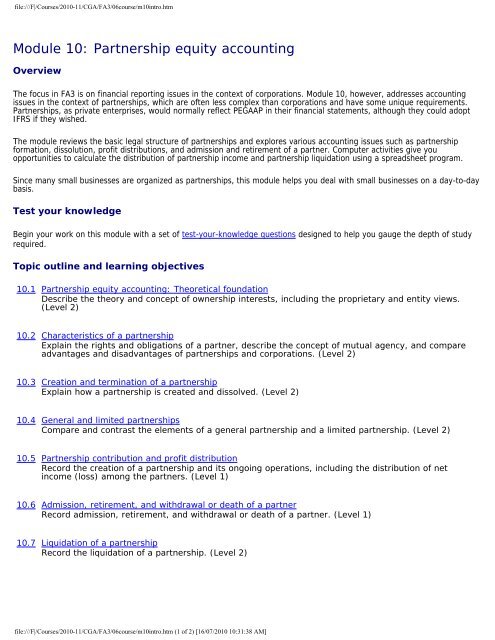

Module 10 Partnership Equity Accounting Pd Net

Solved Assessment 4 Partnerships Exercise 2 Worksheet Chegg Com

Solved Assessment 4 Partnerships 2 Exercise 1 Worksheet Chegg Com

Solved Assessment 4 Partnerships 2 Exercise 2 Worksheet Chegg Com

Reporting Publicly Traded Partnership Sec 751 Ordinary Income And Other Challenges

Solved Assessment 4 Partnerships 2 Exercise 2 Worksheet Chegg Com

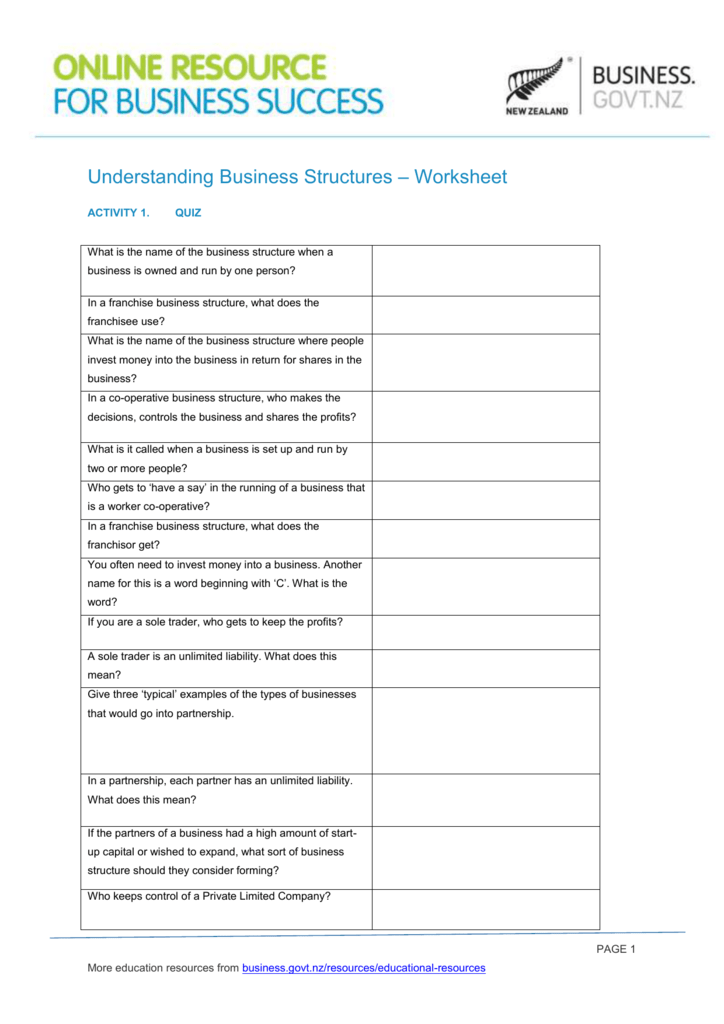

Understanding Business Structures Worksheet

Solved Assessment 4 Partnerships Exercise 2 Worksheet Chegg Com

Partnership Basis Calculation Worksheet Excel 2020 2022 Fill And Sign Printable Template Online Us Legal Forms

Tidak ada komentar:

Posting Komentar